TUMBATU AND KILWA MICROFINANCE PROJECT

YOUTH SELF EMPLOYMENT FOUNDATION

TUMBATU AND KILWA MICROFINANCE PROJECT

2007-2009

End of project report

1.0 Background

Partnership between MICHE and Youth Self Employment Foundation established in 2004.MICHE the financer of UKIJA assigned YOSEFO to takeover the project. A three years grant agreement were signed and YOSEFO were required to build a sustainable microfinance institution that will continue facilitating access of financial service in Ifakara town and Kilombero District at large. In addition to that YOSEFO was also required to supervise the implementation of Education project that was financed by MICHE. The project was implemented successfully and YOSEFO continued to operate after in the project area and is considered to be sustainable. In 2006 MICHE and YOSEFO started the planning phase of Tumbatu-Kilwa Microfinance project. The project was approved in 2006 and implementation started in 2007 in Tumbatu and later in 2008 operations started in Kilwa.

1.2 Project Objectives

The objectives of the project included;

- To provide access to credit to micro entrepreneurs Tumbatu island in Zanzibar and Kilwa District in Tanzania Mainland

- To provide business and technical skills to micro entrepreneurs who are clients of the microfinance project.

2.0 Project implementation strategy

The project has two components , delivery of financial services, mainly credit and empowering the poor through entrepreneurship and business skills training and technical skills training. Two models were used to deliver credit to the target beneficiaries of the project:

Bankijamii model: This model was applied in Jongowe and Gomani in Tumbatu and two villages in Kilwa, Somanga Ndumbo and Somanga Simu. The model involves formation of self administered groups called BankiJamii. One BenkiJamii can have up for 400 members but who are divided in groups forty and small groups of five. The model is ideal in locations where population density is low and/or in remote village which is far away from the branch of the financial institution for this case, YOSEFO. In this model, clients perform some key functions such keeping records on members loans, recording in passbooks, reviewing loan applications and depositing savings in bank accounts. YOSEFO recruited oversight officer who responsibilities included training members and leaders of BenkJamii and providing continues support including auditing records.

Solidarity group model: This is a model ideal in locations where population density is high and the microfinance institution has a branch nearby. This model is a replication of Grameen Bank of Bangladesh but modified to local environment. This model was used at Kilwa Masoko and Kilwa Kivinje. The model requires likeminded people to form groups of five people who are then federated into financial centre of eight groups. The model requires fulltime supervision of loan officers with an optimal case load of 400 clients.

Client training: The project also included a component in clients training in areas of entrepreneurship and Business management and technical skills. Training was offered in order to enable borrowers improve their businesses and including introduction of new products and establishment of new businesses.

3.0 Achievements

Outreach through Benkijamii: A total of 4 Benkijamii were created in Kilwa and Zanzibar. These include Jongowe, Gomani, Somanga Ndumbo and Somanga Simu. The achievements of credit delivery had a mixed result. The performance of the Bankijamiis in terms of loan repayment was good for Jongowe, Gomani and Somanga Ndumbo at PAR rate of 3.9%. The PAR rate at Somanga Simu was very high at 9%. The performance at Somanga Simu was not good hence the project had to stop issuing second round loans and no new clients had been recruited since 2008.

Table 1: Distribution of benkJamii

| Name of B/Jamii | Location | Number of clients | Male | Female | Loan amount disbursed (2007-2009) |

| Jongowe | Tumbatu | 340 | 130 | 210 | 42,910,000 |

| Gomani | Tumbatu | 175 | 45 | 130 | 51,900,000 |

| Somanga Simu | Kilwa | 95 | 15 | 80 | 2,500,000 |

| Somanga Ndumbo | Kilwa | 270 | 105 | 165 | 91,200,000 |

| Total in TZS | 880 | 295 | 585 | 188,510,000 | |

| Total in Euro | 99,215 |

Benkijamii model provides the best opportunity for rural poor to save as they are member owned like Village Savings and Loans Associations (VSLAs). The project provided deposit boxed to each Benkijamii. Small groups of five are also provided with a deposit box in order to assist them build the culture of savings. During the project phase client of each Benkijamii voted for the best saver. Benkjamiis, unlike centres in solidarity lending groups, operate a bank account. The account is used to deposit savings of members. Jongowe and Gomani Benkijamiis have a group of members who observe Muslim, do not take loans because of interest charges but do save.

The Executive Director of YOSEFO handing over a deposit box to the best saver from Gomani Benkijamii

Outreach through Solidarity groups

Solidarity approach of lending was used and continues to be used in Kilwa Masoko and Kilwa Kivinje. These are urban and per-urban areas. The solidarity groups created were of 5 members each with 8 such groups federated into a CENTRE. Loan repayments are on weekly basis at an agreed point on meeting. Loan officers supervise loan disbursement, collection and enter records in the passbooks of the clients. The overall performance of solidarity groups was good with a Portfolio at Risk of 1.7%. The success of lending through solidarity groups was due to requirement for weekly meetings, close supervision by loan officers and urban set-up which provided good business potential. The performance of solidarity groups was further enhanced by training provided through project’s funding.

Table 2: Distribution of Solidarity Group loans

| Location | Location | Number of clients | Male | Female | Loan amount disbursed (2007-2009) |

| Kilwa Masoko | Kilwa | 215 | 75 | 140 | 207,000,000 |

| Kilwa Kivinje | Kilwa | 260 | 95 | 165 | 294,800,000 |

| Total in TZS | 475 | 170 | 305 | 501,800,000 | |

| Total in Euro | 264,105 |

Training of beneficiaries

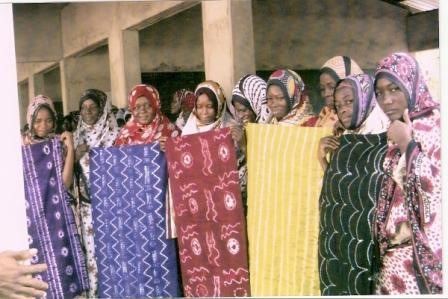

One of the main reasons why this project is successful and achieve good repayment rate is the training program. Project clients received training on tie and dye and batik (Jongowe, Gomani and Somanga Ndumbo), entrepreneurship and business skills, leadership skills and record keeping for treasurers of Benkijamiis. T he most important components for women clients was training on tie and dye and batik and entrepreneurship as it enabled them to diversify their businesses. Entrepreneurship was a critical element of the training which provided women with an opportunity to change their behavior particularly in areas of innovation and creativity. Benkijamii of Jongowe also received training on management of fish products and on how to make a post cards.

Trained women Jongowe displaying products

Role play during entrepreneurship training

4.0 Project Sustainability

Assessment of the project’s sustainability, cannot be made without first considering a definition. Sustainability in the context of the micro credit project is defined as “capability of the project’s activities being carried on” after December 2009. All indications show that the Tumbatu-Kilwa Micro Credit Project is sustainable. Loans are being repaid, majority of clients/beneficiaries continue to access financial services and YOSEFO has expanded the services to other communities in Zanzibar and Kilwa. As of now over 4000 clients in 23 communities are being serviced by YOSEFO in Zanzibar and Kilwa.